ADMINISTRATION

Rodney R. Haines, Township Administrator

(609) 296-7241 ext 220

administrator@leht.com

Fax: (609) 294-3040

Back to Top ▲

CONSTRUCTION

CALL BEFORE YOU DIG

MAIN NUMBER: (609) 294-9071

FAX: (609) 294-9065

Karl Held, Construction Official

(609) 296-7241 ext. 618

kheld@leht.com

or (609) 296-7241 and choose one of the following extensions

Building Subcode Official: Bill Marshall ext. 613 | Electrical Subcode Official: Jack Helmstetter ext. 600 | Plumbing Subcode Official: Larry Ditzel ext. 614

Zoning Officer ext. 616 | Assistant Zoning Officer ext. 615 | Code Enforcement Officer ext. 617 | Housing & Bulkhead Inspector ext. 161

Construction Department Clerks

Betty Ann: ext. 609 | Monica: ext. 610 | Jenna: ext 611

Ordinance 2023-05 (Short Term Rentals)

COVID-19 OUTDOOR DINING PERMIT

***Effective November 7, 2016: All new construction, additions and substantial improvements in flood hazard areas will require two (2) foundation location surveys (prepared by a New Jersey Professional Land Surveyor) showing all building corners and the elevation of the top of the foundation. The documentation as per N.J.A.C. 5:23-2.18(b)1.ii.(1)&(2) and Township Ordinance #2004-08 shall be required prior to further vertical construction. ***

R-50 Zone requirements and 2013 Amendments

***Please see the attached information released from the State of New Jersey regarding “Houses on Pilings.”***

For additional assistance or permit forms you can click here.

UCC FORMS

MISCELLANEOUS FORMS

NEW CONSTRUCTION FORMS

New Construction Application Requirements

Checklist Requirements for a Certificate of Occupancy for House Raise

Checklist Requirements for a Certificate of Occupancy for New Construction

Preexisting Certificate of Occupancy (Residential) Application

Preexisting Certificate of Occupancy (Commercial) Application

Back to Top ▲

FINANCE

Rodney R. Haines, Certified Municipal Finance Officer

(609) 296-7241 ext. 226

finance@leht.com

Kasey Powers, Qualified Purchasing Agent

(609) 296-7241 ext. 235

Fax: (609) 294-3040

finance@leht.com

BIDS, RFPS, & RFQS

Bid Notice:

Demolition of Structure on 110 National Union

Demolition of Structure on 360 Route 9 South

Little Egg Harbor Best Practices Inventory

2023 Documents:

2022 Documents

2021 Documents

2020 Documents

2019 Documents

2018 Documents

2017 Documents

2017 Annual Financial Statement (for the year end 2017 audited)

Annual Financial Statement (for the year 2017 un-audited)

Audit Report for the Year Ended 12-31-17

2017 Adopted User Friendly Budget

2017 Introduced Budget

2017 Adopted Budget

2016 Annual Financial Statement

Audit Report for the year ended 12/31/16 (revised) & Supplemental Exhibits

Back to Top ▲

HUMAN RESOURCES

Anna Nelson, Payroll

(609) 296-7241 ext. 224

FAX: (609) 294-3040

Katherine Baker, Human Resources

(609) 296-7241 ext. 223

FAX: (609) 294-3040

Application for Township Employment click here

For information on Employment Applications for the Police Department:

please click here – Official Police Department website

Back to Top ▲

MUNICIPAL COURT

LITTLE EGG HARBOR TOWNSHIP MUNICIPAL COURT / EAGLESWOOD TOWNSHIP MUNICIPAL COURT

665 Radio Road

Little Egg Harbor, NJ 08087

Phone: (609)296-7241 Ext. 300, 301, 302 & 303

Fax: (609)294-1068

JUDGE: Honorable Daniel Sahin

EAGLESWOOD TOWNSHIP IS A SHARED COURT WITH LITTLE EGG HARBOR. IF YOU HAVE MUNICIPAL COURT MATTERS IN EAGLESWOOD, PLEASE CONTACT LITTLE EGG HARBOR MUNICIPAL COURT AT THE PHONE NUMBERS LISTED ABOVE.

VIRTUAL COURT PROCEEDINGS

In an effort to mitigate public exposure to Covid-19, Little Egg Harbor Township and Eagleswood Municipal Court will be conducting virtual court sessions. A virtual court session is a legal proceeding and is treated as if you were physically in the courtroom. The court is utilizing ZOOM to conduct our proceedings. If you wish to resolve your case virtually, you will not have to physically appear in court. The court is reaching out to parties with pending court dates. If you haven’t spoken to the prosecutor do not worry, you will also have an opportunity to speak to the prosecutor virtually on the day of court.

Before your Court Date

– If you don’t already have Zoom downloaded to your smartphone, PC, laptop or tablet, please do so upon receiving your emailed court notice. This will avoid any delays on the day of court. You may contact the court in advance to schedule a test session.

– You must view the videos:

Municipal Court Opening Statement (English)

https://youtu.be/To_oOyvCIoc

Municipal Court Opening Statement (Spanish)

https://www.youtube.com/watch?v=edxI4gJnqa4.

Municipal Court Opening Statement Introduction (Spanish)

https://www.youtube.com/watch?v=ROn9vAILINQ.

(When joining the Court session you will be asked to certify that you watches the Judge’s opening remarks.)

Attending Municipal Court Remotely: What to do and What to Expect

Day of Court

– Log onto the court session at least 15 minutes prior to your scheduled time. This will allow you the opportunity to resolve any technical issues. Remember to click yes when you get a message from your electronic device asking for permission to access your camera and microphone.

– Please be in a quiet room to avoid background noise. If possible, use earphones to avoid any feedback.

– Dress appropriately! Please be advised you will be recorded and should be acting in a fashion that is accepted in an actual courtroom.

– Upon entering the virtual courtroom, you will be in a waiting room and will remain in that room until the court staff let you into the court.

– After you are admitted into the main room, your microphone will be muted and remain muted until your case is called. A brief explanation of the process will be given and then you will be put in a breakout room. You will wait in the breakout room for the prosecutor to join the room to discuss your case privately. No one else will be in the room so no one can hear your conversation. Note: the prosecutor will be speaking to everyone scheduled for court so you may be waiting for a period of time. When you are done speaking with the prosecutor, leave the breakout room not the meeting.

– When the Judge takes the bench everyone’s microphones will remain muted. The court will request that you unmute your mic when your case is called.

– Upon completion of your case, the judge will excuse you. Your microphone will once again be muted at which point you may leave the session/meeting.

– If for any reason you need to contact the Court directly, please call (609)296-7241 ext. 301 or ext. 303, or e-mail alina.bertram@njcourts.gov or lesley.kirchgessner@njcourts.gov.

AS PER AOC RULES, AUDIO AND VIDEO RECORDING OF THE PROCEEDINGS ARE STRICTLY PROHIBITED. IF YOU WOULD LIKE A COPY OF THE PROCEEDING, YOU CAN FILL OUT A JUDICIARY REQUEST FORM WHICH CAN BE FOUND AT NEW JERSEY COURTS ONLINE.

After Court

– The Judge will discuss with you your payment options.

– If you were assessed fines and costs and would like to pay with a credit card, we accept VISA, MASTERCARD or DISCOVER for Little Egg Harbor matters. Please allow 48 hours before your payment can be called in. Payments can also be made on the State’s website, NJMCdirect.com.

– If you were assessed fines and costs in Eagleswood, your fines can be paid by mailing in a check or money order or payments can be made on the State’s website, NJMCdirect.com

UPCOMING VIRTUAL COURT DATES

You are required to watch the Virtual Court Opening Remarks anytime prior to the court session. By joining the virtual session, you are certifying that you have watched the opening remarks. Please note if you watch the opening remarks on the day of court you must still register below for the appropriate date and click on the link sent to you by ZOOM, it does NOT automatically take you into the court session. After registering for your session, you will receive a confirmation email directly from ZOOM on behalf of the Court Administrator, containing information about joining the session. If time has passed and you haven’t received the confirmation email, please check your junk/spam mail.

Little Egg Harbor Township/Eagleswood Virtual Court Sessions:

Date: April 15th, 2024 at 9am

** After registering, you will receive a confirmation email directly from Zoom, on behalf of the court administrator, containing information about joining the session. If time has passed and you haven’t received the confirmation email, please check your junk/spam mail or call our office so that we can verify registration has been made and we can send a duplicate link. **

LITTLE EGG HARBOR / EAGLESWOOD MUNICIPAL COURT INFORMATION

COURT ADMINISTRATOR:

Jodie Termi, CMCA

DEPUTY COURT ADMINISTRATOR:

Lesley Kirchgessner, DCA, CMCA

Email: lesley.kirchgessner@njcourts.gov

VIOLATION BUREAU WINDOW HOURS:

MONDAY THRU FRIDAY 8:30 A.M. TO 4:00 P.M.

CITIZEN COMPLAINTS ARE TAKEN 9:00 A.M. TO 3:00 P.M.

For updated information, visit the New Jersey Judiciary’s website at www.njcourts.gov.

Forms:

Application for the Public Defender

New Jersey Judiciary Municipal Court of NJ Complaint Information Form

Back to Top ▲

POLICE DEPARTMENT & POLICE RECORDS

Main Number: (Non- Emergency) (609) 296-3666

Confidential Tip Line: (609) 294-3030

Communications Fax: (609) 812-1758

Police Records Department: ext. 103, 104, 105

Records Fax: (609) 296-4025

Official Police Department website

***FOR EMERGENCY UPDATES BY THE LITTLE EGG HARBOR TOWNSHIP POLICE DEPARTMENT, PLEASE REGISTER AT: http://www.nixle.com/ ***

Little Egg Harbor Township Citizen’s on Patrol (COP’s)

Contact Lt. Jeff Martin at 609-296-3666 x 160

Sgt. Sean Crotty at 609-296-3666 x 175

Meets the 2nd Wednesday of every month / 7:00 pm – 9:00 pm (except in July & August)

Little Egg Harbor Senior Center, 641 Radio Road

Back to Top ▲

PUBLIC WORKS & RECYCLING CENTER

Little Egg Harbor Township Recycling & Compost Center

1363 Route 539, Little Egg Harbor Twp.

609-296-5760

*Per the rules and regulations of the Township, the DPW recycling center is for the use of Little Egg Harbor Township residents only and it is required to provide proper ID and proof of address before entering the center.

Schedules for Zone Schedule for bulk pick-up and brush, Trash pick-up, and Recycling pick-up

Click Links Below to View:

Household Hazardous Waste Program 2024

2024 Ocean County Residential Document Shredding Program

Hours of Operation: Weekdays (except holidays) 7:00 am to 3:00 pm

Saturdays (except holidays) 7:00 am to 3:00 pm

Little Egg Harbor Township 2007 Municipal Stormwater Management Plan

Stormwater Control Ordinance for areas outside of the Pinelands

Stormwater Control Ordinance for areas within the Pinelands

For information on damage to personal property during Township operations (i.e. damage to mailbox during snow removal), please read the following Township Ordinance.

Sign Shop

If you notice a missing street sign, speed limit sign or stop sign, please report it to: dpw@leht.com

Street light outages are reported directly to Atlantic City Electric.Click here for details

Used Clothing Drop-off Shed

Located at the Recycling Center (DPW Yard)

Items Accepted: clothing, shoes, sneakers, belts, purses, blankets, sheets, pillowcases, drapes and stuffed toys.

Your donations will not be cut up or shredded. We do not accept rags, fabric scraps, toys or household goods.

Back to Top ▲

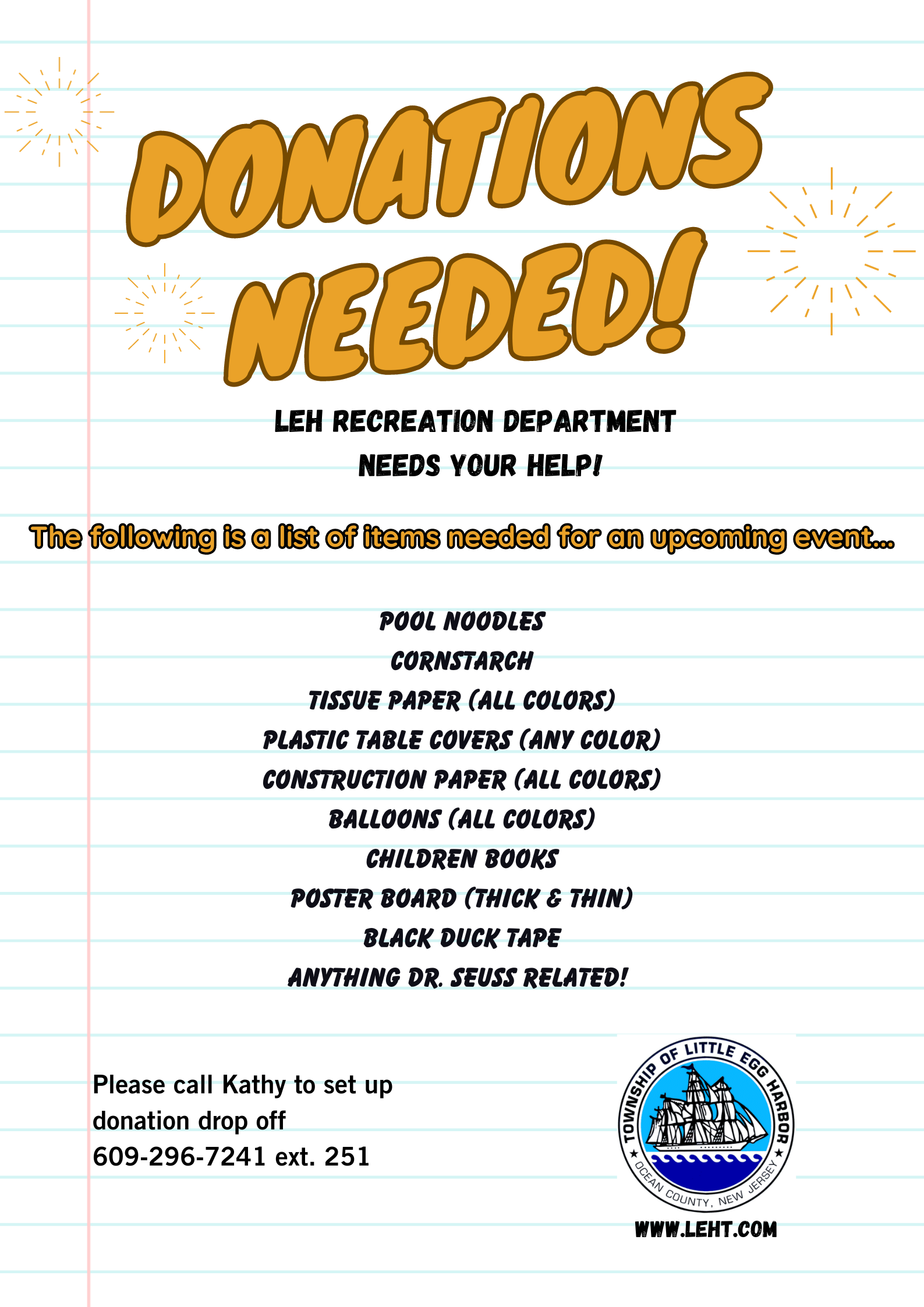

Recreation Department

Kathy Tucker, Recreation Director

ktucker@leht.com

609-296-7241 ext. 251

If you are interested in being a Volunteer for events that will be hosted by Little Egg Harbor Township, click the link below to fill out a Volunteer Application:

Volunteer Application (Under 18 years old)

Back to Top ▲

TAX ASSESSOR

Mandi Johnson, CTA – Tax Assessor

(609) 296-7241, ext. 247

Tax Assessor’s Office

extensions: 244, 245 & 246

Fax: (609) 296-5352

assessor@leht.com

Location and Description of Properties

All parcels within the municipality are identified by Block and Lot numbers.

Blocks are larger geographical descriptions in numerical sequence using streets, highways, prominent streams, etc. as boundaries.

Lot numbers are smaller descriptions of individual parcels numbered in sequence within each Block.

The Little Egg Harbor Township Tax Map is available in the Assessor’s Office to assist in both locating and describing all parcels in the district. In addition, the Little Egg Harbor Township Tax List annually lists all properties in the municipality numerically in Block and Lot order starting from Block #1, block numbers first.

You may wish to link to or access http://www.ocnjtax.com/ to obtain this information more easily.

Determining Taxability

Most residential properties are taxable for real estate tax purposes under N.J. State Statutes unless a specific provision exists that provide for full or partial tax exemption.

An example of tax exemption would be ownership and principal use by a totally (100%) percent disabled veteran with a service-connected disability.

This function is typically more applicable in providing tax exempt status to the many municipal, state and county properties within Little Egg Harbor Township as well as to those qualifying organizations. ex.: churches, hospitals, veteran’s organizations

To a lesser extent the determination of taxability is important in providing the distinction between real and personal property. Assessed valuations are based upon real property. Items considered to be personal property are not included in Little Egg Harbor assessed valuations.

Next, a review of existing Property Tax Benefits should be made to determine if you qualify for any of the various tax deductions available. The property tax deductions available through the Assessor’s Office include: (1) Veteran or Surviving Spouse Deduction, and (2) Senior Citizen/Disabled Person/Surviving Spouse Deduction.

The qualifications for these property tax deductions are highlighted here for general information purposes but actual approval will be based upon a timely completed application with all appropriate supporting documentation.

Veteran/Surviving Spouse Deduction requirements (forms are available in the Tax Assessor's Office)

1. Ownership and New Jersey residency as of October 1 of previous year

2. Honorably discharged U.S. Armed Forces veteran or unmarried surviving spouse of veteran or active service person – original record of service or DD214. – (click here for DD214)

3. Military service during certain war, conflict or “peacekeeping mission” time periods

4. Completed application

Annual benefit – $250.00 for 2003 and thereafter

General Information

1. A veteran or surviving spouse may also apply for and receive a senior citizen/disability/surviving spouse deduction if qualifications are met.

2. No more than one (1) senior citizen/disability/surviving spouse deduction of $250.00 may be applied to a property annually.

3. Husband and wife veteran combinations or surviving spouse and simultaneous veteran combinations may receive dual tax deductions.

4. There is no authority to approve a tax deduction for a prior calendar year – please file applications during the year of eligibility. Filed means received in the Assessor’s Office.

Establishing and Maintaining Assessed Values at the Common Level

Annually, in late September, a report is published by the State of New Jersey, Division of Taxation known as the “Table of Equalized Valuations”.

This report lists the certified Average Ratios in each municipality in New Jersey. It is calculated by comparing assessed values in given years with the actual arms-length sales of properties in the municipality on a property class basis. Property classes include vacant land, residential, and commercial properties. The end result or Weighted Ratio is one of several measures that can be used to determine the accuracy and uniformity of assessing practices within the taxing district.

The Ratio for 2006 for Little Egg Harbor Township is: 100.00%

This number will be referred to as the “common level” or average ratio of assessed to true values. It may assist the taxpayer in determining if the assessed value placed upon his/her property by the Assessor and Ocean County Tax Board is fair. As a general guide, you will first have to determine the market value of your property. A review of similar properties that have sold in arms-length transactions, a recent appraisal by a competent professional or a recent sale of the subject property could be utilized to this end. Multiplying the appraised value times the “common level” ratio will produce a number that can be compared to your actual assessed value totals.

Example: Property Value x Ratio (100.00%)

$300,000. 1.00 = $300,000.

Assessed Value – $295,000. (Fair)

Assessed Value – $320,000. (High)

You will be notified annually on or before February 1st of the tax year of the assessed value of your property. The annual notice is in the form of a post card mailed to the address of record. The notices includes a land, building and total assessment for administrative purposes as well as prior year’s annual taxes exclusive of interest, penalties and/or added assessments. You should not use this notice for federal and state income tax purposes.

Lastly, there are periodic assessed value changes that are made annually on a neighborhood-wide basis. Recent legislation requires submission of a plan and subsequent approvals from the County Board of Taxation and the State Division of Taxation as well as notice to the municipality prior to implementing these changes. These changes are necessary in order to maintain acceptable levels of assessments within the municipality. Since the Assessor’s Office is clearly responsible with maintaining assessments as close as possible to full and fair market value, annual changes in assessments must be made to adjust for value changes experienced in area neighborhoods.

Defense of Assessments

After you have received your annual tax assessment notice and have had the opportunity to compare your assessment to the market value of your property, you will have an educated idea of the fairness of your assessment. If you have specific questions in this regard, please feel free to contact this office weekdays between 8:30 A.M. and 4:30 P.M. to schedule an appointment for further review. If after review you are not satisfied that the assessed value of your property reflects a lawful relationship to market value, you may wish to file a formal tax appeal. You must contact the Ocean County Tax Board at the address and phone number on the reverse of your Tax Assessment Notice. A review of some common misconceptions in this regard will assist you in your decision to proceed:

1. Land and building assessments cannot be appealed separately

2. Property taxes are not an issue during an appeal since the Assessor’s Office and County Tax Board has no control over the budgets submitted by the Municipality, County and/or school systems.

3. The municipality cannot accept for filing a petition intended for the County Tax Board.

4. The filing deadline is April 1st of the tax year at issue. Filed means received at the offices of the Ocean County Tax Board, Washington Street, Courthouse, Toms River, New Jersey.

5. Comparable assessments of other properties are not acceptable as evidence of the value of your property.

6. Assessments cannot be avoided by the failure or refusal to obtain a certificate of occupancy from the Construction Department.

7. Payment of the first quarter real estate taxes and municipal charges (water, sewer, etc.) are a pre-condition to the satisfactory completion of the appeal process.

While this office neither encourages nor discourages the filing of tax appeals generally, we will attempt to resolve discrepancies by stipulation if at all ethically possible. If the assessment is defensible, we will provide the taxpayer with supporting evidence to defend the assessed values placed upon the Tax list. A settlement stipulation completed sufficiently in advance of a scheduled appeal hearing will serve to avoid an unnecessary appearance before the Ocean County Tax Board at the designated hearing location.

We trust that the information provided here, although not all-inclusive, will help you in understanding the functions of our office and assist you in your quest for public information and service.

Back to Top ▲

TAX COLLECTOR

Dayna Wilson, CTC – Tax Collector

Main Office Number: (609) 296-7241 ext. 240

Extensions: 241, 242, 243

Fax: (609) 296-8516

E-mail: taxcollector@leht.com

Little Egg Harbor Township On-line Tax Account Look-up & Payment Section

On-line Tax Payment Convenience Fees

Please be advised that Credit Card and E-Check payments can only be made via the internet

and that there are convenience fees that will be charged to the user for each transaction.

*Please note that the fee for using a debit card is the same fee as using a credit card.

If you have the funds in your checking account, as of April 2, 2020 the fee for using an e-check is a flat $1.95 per transaction,

instead of the 2.95% of the transaction amount incurred for credit / debit cards.

**Convenience fees are retained by the service provider and are not paid to, or shared with, the Township of Little Egg Harbor.**

Payment at Tax Collector’s Window Update:

Please be advise that the Tax Collector’s office is now accepting credit card payments at the window for their convenience.

There is a service charge of 2.95% of the transaction that will be added to the payment.

Thank you!

Please click the links below for the following:

Payment of Property Taxes and Property Tax Information

The Tax Collector’s Office is responsible for the billing and collection of property taxes that supports the following local government entities:

Ocean County

Ocean County Library

Ocean County Health

Ocean County Open Space

District School (Little Egg Harbor Elementary Schools)

Regional School (Pinelands Regional Schools)

Municipal Open Space

Municipal Local Tax

Fire Districts 1, 2 and 3

Tax bills are issued in June or July of each year and are payable quarterly.

Payment dates are: February 1st, May 1st, August 1st and November 1st

A ten (10) day grace period is given. If the 10th falls on a weekend of holiday, the grace period is extended to the next business day. Interest charges accrue back to the first of the month on delinquencies.

Interest

The interest listed on delinquent amounts is calculated to today’s date.

Interest must be paid in full and will be deducted first, before any monies are applied to taxes.

Once interest is deducted, monies will be applied to the oldest taxes first.

Please contact our office at 609-296-7241 ext. 240 or 241 to obtain interest calculations for a future date.

Tax Account Look-up Disclaimer

Tax account look-up is for informational purposes only and does not constitute a Municipal Tax Search.

Account information is subject to updates, corrections and reversals.

The Township of Little Egg Harbor is not responsible for erroneous interpretation of the records

or for changes made after the look-up.

Assessment Values

The assessment values that appear on the Tax Account Look-up section are from the last update to the Municipal Assessor’s records, which only occurs twice a year, and may not reflect the assessed value on the Assessor’s records.

Please keep in mind that the Assessor’s records are always one year ahead of the current year.

Municipal and; Third Party Tax Liens

Municipal & Third Party Tax Liens cannot be paid on-line.

All redemption of liens must be made through the Tax Collector’s Office with certified funds, such as a cashier’s check, money order or cash. Redemption figures must be requested in advance and may take three (3) or more business days to be provided. (**On-line Tax Accounts with Third Party Tax Liens may report taxes as paid, however, the taxes may have been paid by the lien holder and are still due as part of the Third Party Tax Lien. Municipal Liens may also report taxes as paid, however, the taxes may only have been transferred to the lien and still due as part of the Municipal Lien.**)

Properties in Bankruptcy

Tax accounts that have an open balance at the time of the bankruptcy filling may have those balances transferred to a Special Charges Account. Any taxes transferred to a Special Charges Account will appear paid on the Regular Tax Account, but will still be due and owing under Special Charges.

Properties in bankruptcy cannot be paid on-line.

Special Charges Accounts

Special Charges Accounts contain balances that are due in addition to the Regular Tax Account.

Please contact this office at 609-296-7241 ext. 240 or 241 to obtain further information on accounts that are noted as having “special charges”.

Refunds

Once taxes are paid on-line, refunds will not be be permitted.

If monies paid result in an overpayment of taxes, please contact the Tax Collector’s Office for assistance.

Please make sure you are paying on the correct account prior to making payment.

To Enter the On-line Tax Account Look-up and Payment Section

To enter the On-line Tax Account Look-up and Tax Payment section you are stating that you have read the above items regarding the convenience fees that will be charged for on-line payment, as well as the information regarding Tax Account Look-up and the disclaimer, and agree to continue under those conditions.

Agree and continue to tax payment site

The Tax Sale for the Township of Little Egg Harbor is accelerated and held mid to late December for any current-year municipal delinquencies, including the Little Egg Harbor Municipal Utilities Authority water and sewer delinquencies. To avoid the process of Tax Sale, bring all tax, water and sewer charges current by November 10th. The Tax Sale process begins November 11th.

Property tax deduction applications for senior citizens, disabled persons or surviving spouses of seniors or disabled persons are available from the Tax Assessor’s Office.

Hours: Daily 8:30 a.m. to 4:30 p.m.

Taxes can be paid at the Tax Collectors office located on the first floor of the Little Egg Harbor Administrative Justice Complex or by mail to:

665 Radio Road, Little Egg Harbor Township., NJ 08087.

The Tax Collector enforces delinquencies through the Tax Sale process.

TAX FORMS

Change of Mailing Address Form

Tax Sale List Request

Request for Certificate of Redemption

Request for Tax Lien Statement

State of New Jersey Property Tax Relief Programs – click here for additional information

Back to Top ▲

TOWNSHIP CLERK

KELLY LETTERA, CMC, RMC

Township Municipal Clerk

clerk@leht.com

Extension 233

Susan Kramer, CMR

Assistant Municipal Clerk/Registrar

skramer@leht.com

Extension 230

Jillian Williams, CMR

Deputy Registrar/Clerk 1/Notary

jwilliams@leht.com

Extension 231

Brian Flynn

Clerk II/Alternate Registrar/Notary

bflynn@leht.com

Extension 232

Main Number: (609) 296-7241

Fax: (609) 296-5352

CORE DUTIES OF THE TOWNSHIP MUNICIPAL CLERK

The Municipal Clerk is one of the positions required in all municipalities by state statute, and requires a state certification which must be maintained through continuing education. The position of Municipal Clerk is required by New Jersey statute (N.J.S.A. 40A:9-133) to function as:

*Secretary of the Municipal Corporation

*Secretary to the Governing Body

*Chief Administrative Officer of all Elections held in the Municipality

*Chief Registrar of Voters in the Municipality

*Administrative Officer with responsibilities pertaining to the acceptance of applications for licenses and

permits and the issuance of licenses and permits

*Records Coordinator and Manager

*Other duties that may be imposed by state statutes and regulations or municipal ordinances or regulations.

Additionally, the Municipal Clerk’s Office often serves as a link between the municipality’s residents and local government officials.

Additional Information:

New Jersey Alcoholic Beverage Control

Legalized Games of Chance Control Commission Applications

-Election forms are also available in the Municipal Clerk’s Office. Residents must be 16 years of age or older at the next ensuing election to register.

-Residents can register under the “No Knock” Ordinance in the Township Clerk’s Office and obtain a copy of the sticker if you wish to place one at your residence.

REGISTRAR & VITAL RECORDS

Susan Kramer, CMR, Registrar of Vital Records

skramer@leht.com

(609) 296 – 7241 ext. 230

Marriage License Applications and Certified Copies of Vital Records

- Application for Marriage or Civil Union in New Jersey

- Application for a Marriage/Remarriage/Civil Union or Reaffirmation License

- Local Wedding Officiant List

- Application for a Certified Copy of a Vital Record

- Application Requirements for Certified Copies

Acceptable Forms of Identification:

- Valid photo driver’s license or photo non-driver’s license with current address.

or

- Valid driver’s license without photo and an alternate form of ID with current address.

or

- Two alternate forms of ID, one of which must show the current address.

Alternate Forms of ID:

|

|

When requesting a vital record, proof of relationship must be provided.

As required by state regulation, non-genealogical vital records must be fully identified. For example.. exact name, date, and location.

Non-genealogical records are defined as: Deaths occurring within the last 40 years, births occurring within the last 80 years, marriages within the last 50 years, and all civil union and domestic partnership records.

Fees

- Marriage License Application: $28.00

- Certified Copies: $10.00 each

Cash, check or money order are accepted. Please make checks payable to Little Egg Harbor Township.

Office Hours

By Appointment only (609) 296 – 7241 ext. 230

Land Use and Development

Chapter 215 – Land Use and Development

Township Code Book

Back to Top ▲

ZONING & CODE ENFORCEMENT

Zoning Office

(609) 296-7241 ext. 616

zoning@leht.com

John Cooley, Assistant Zoning Officer

(609) 296-7241 ext. 615

Frederick Cramer, Housing Inspector

(609) 296-7241 ext.161

Michael Fromosky, Code Enforcement Officer

(609) 296-7241 ext. 617

codeenforcement@leht.com

RENTAL PROPERTY MERCANTILE LICENSE

A rental property Mercantile License is required for all properties and is required prior to submitting and/or scheduling a Rental Certificate of Occupancy Application.

Click here to view the application

Complaint Forms can be completed and turned into the Township Clerk’s Office at the Administrative Justice Complex.

Such forms are used for property maintenance complaints, zoning issues, animal complaints, etc. This form is not used for criminal complaints.

1999 Master Plan

Chapter 215 – Land Use and Development Ordinance

Final 2017 Little Egg Harbor Housing Plan and Fair Share Element

Reexamination Report and Master Plan Amendment

Master Plan Reexamination Report and Update of the 1990 Master Plan

Zoning Application

ZONING FORMS

COVID-19 Outdoor Dining Permit

Application for Registration to Raise and Keep Fowl

Application for Rental Mercantile License

Commercial Application for Mercantile License

Existing Structure Certificate of Occupancy Application (Commercial)

Existing Structure Certificate of Occupancy Application (Residential)

Temporary Waiver of Certificate of Occupancy

Back to Top ▲